When people think about consultants, they often think about those that work for companies like McKinsey, Accenture, Deloitte, etc. These are companies that are essentially independent from product vendors. However, there are a number of companies that provide consulting or professional services as part of product companies (e.g., companies like Cisco, Avaya, Nortel, Ericsson, IBM) that may sell things like hardware or software. I’ve had the opportunity to incubate and/or reboot the management, sales, marketing, and delivery for a number of these types of consulting practices, and they definitely face a number of issues that are unique from independent consulting firms.

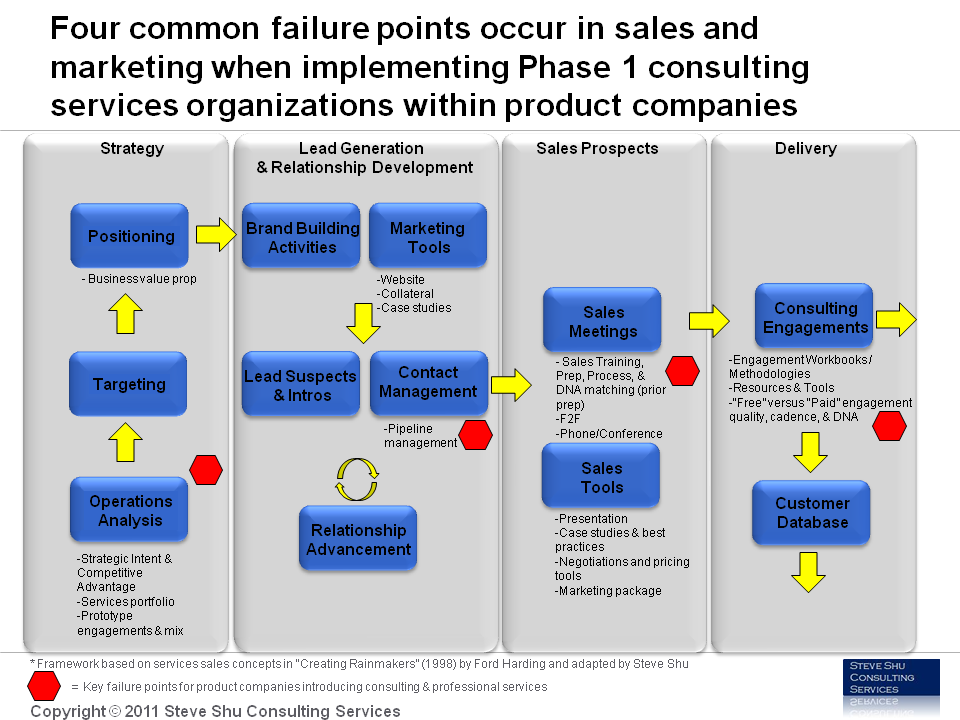

As an example of a jumpstart “Consulting Services for Product Company” engagement, I have often found four common failure points to look out for when examining the organization from an end-to-end view from strategy through sales and delivery (see figure below which hints at the sales learning curve an organization must work through). The failure points are:

- Unclear, strategy for providing consulting services – An example of unclear strategy includes not being able to articulate to what extent consulting services should be designed to protect product lines versus providing a new revenue stream. Also, what are the types of consulting services to be provided (the services portfolio)?

- Unclear method for getting leads into the pipeline – Depending on strategy, consulting services organizations within product companies are often implemented as overlay organizations, and as such, the process of getting in front of customers and managing prospects can lack proper definition, discipline, and support tools. Often the buyer in the organization is different too.

- Improper tone for sales meetings – Product companies are often used to marketing-push type sales strategies (e.g., “here’s the benefit and features of our product – its the best”). On the other hand, consulting services sales are often more diagnosis, empathy, and solution-driven. Getting the right mix between product and services messaging takes some work.

- Irregular quality of consulting services project delivery – In some cases, consulting services may be may be provided as an afterthought or on a “free” basis to customers (e.g., subsidized by product sales). Unfortunately, a customer’s time is money, so even if the service cost is covered elsewhere, the consulting organization still needs to provide quality work to the customer.

Implementing consulting organizations within product companies can be a great opportunity. That said, I’ve provided a peek at some of the hazards involved. What has your experience been with consulting and professional services organizations within product companies?