One concept that I describe in my recent book, Inside Nudging: Implementing Behavioral Science Initiatives, draws from Roberto Verganti. He uses the term, “Design-Driven Innovation.” I re-coin the concept as “Meaning-Driven Innovation” to ease the explanation a bit. The concept is that in order to innovate under such a framework, one needs to change the relationship between the product or service and the end user. In this framework, the designer must address the question, “what does the product or service mean to the end user?”

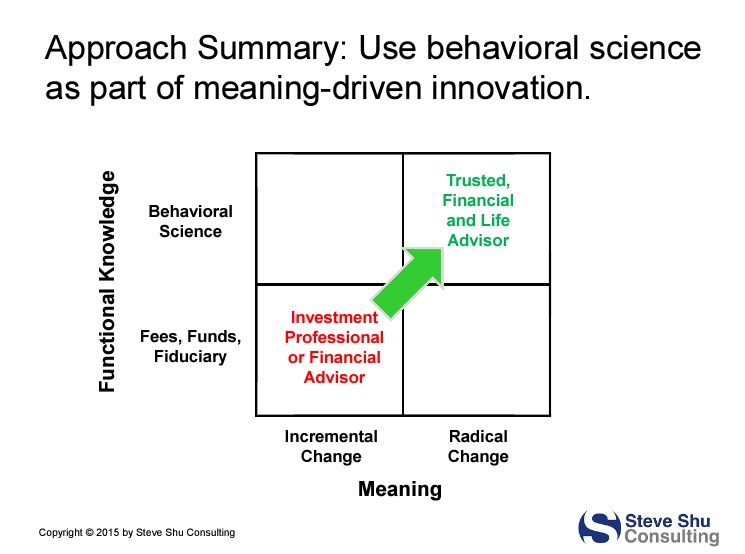

In my book, I describe how colleagues and I created an app to help retirees plan for their retirement journey with guidance from a financial advisor. This effort involved equipping financial advisors with some software tools (informed by the behavioral sciences) that they could use with retirees to help the retirees discover blindspots, form priorities and deal with cognitive/emotional difficulties, and reflect on risks more thoroughly. The upshot of our design approach was to try to change the relationship between the advisor and retiree. We wanted the advisor to mean more to the retiree than just a person involved with fees, funds, and fiduciary responsibility. We wanted advisors to evolve to become trusted financial and life advisors. See a figure from my book below:

The meta meaning that we played to one was about connection, creating a new connection between the advisor and retiree. There are other meta meanings to describe relationships with products and services though. For example, there can be products that help to transform people. Or there can be products whose design and meaning are to protect. Or products can be designed to make a person feel more in control.

In summary, one possible relationship between behavioral science, design, and innovation is about changing the meaning between products/services and people through use of behavioral science principles (whether these principles come from psychology, behavioral economics, or the like).

This post has been cross-posted as an answer to a question posed on Quora.