I teach a couple of consulting projects-type courses at Cornell. One is a Grand Challenges capstone-class for Dyson undergraduates in helping companies and organizations address one or more of the 17 UN Sustainable Development Goals. The other is a flagship-project class that is part the Masters in International Management program as part of the global CEMS Alliance, and it involves student collaborations and exchanges with 33 other top business schools and universities.

Each of these cohorts has different team compositions, problem statements, and situations to address for their client. Projects can involve diverse topics like addressing sustainability of the food supply chain and manufacturing capacity, promoting economic development and greater social equality in another continent, customer and market fit of a new product, workforce evolution given Gen Z, or marketing, branding, and product strategy for an international company.

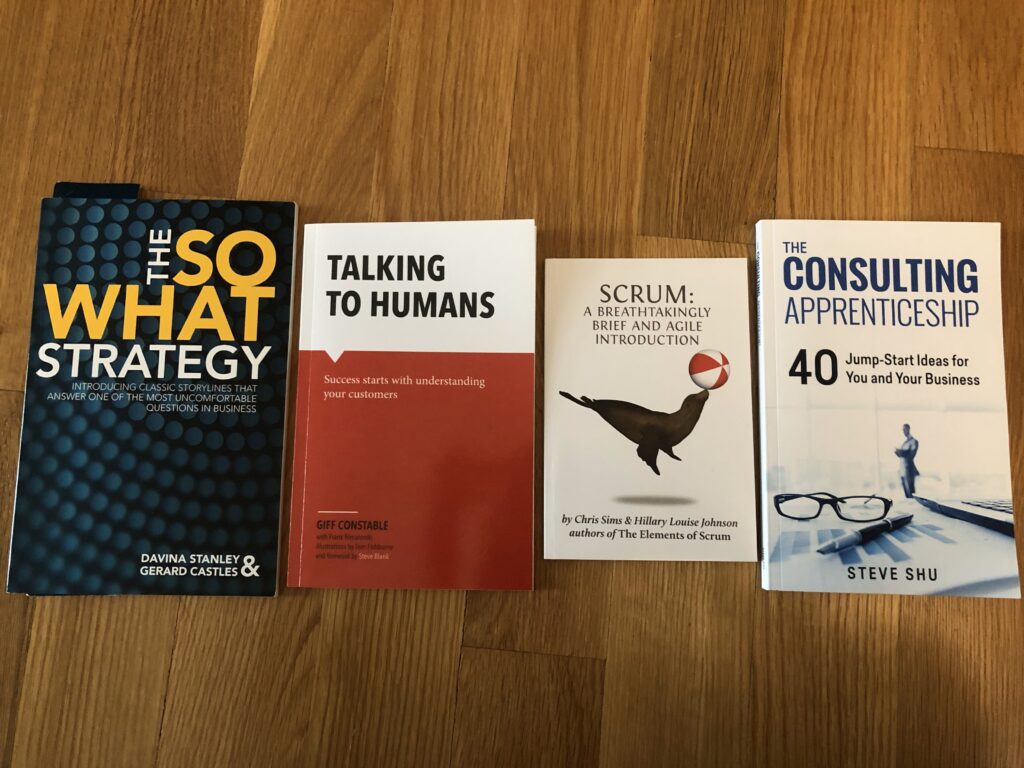

Although projects are diverse and hard to find common bases of foundational knowledge, I have found it helpful to have bite-sized jump start material to help students get grounded. As part of the core, I have provided excerpts from my own book on bread and butter consulting concepts (for free), references to The So What Strategy for consultative communications, and a breathtaking short pocket reference to Scrum. These are all quite short books as evidenced by the spine thickness. People don’t have a lot of time to read given the heft and time pressures of projects.

Given that quite a few projects involve customer discovery, market fit, and/or diverse constituent interviews, I have decided to also add “Talking to Humans” as part of the reference books that I’ll draw from for these courses. It is a quick read book that can be completed in 1-2 hours. And it can be a great book to go back to for quick reference before doing any qualitative customer / product research.