Last night I had a good dinner and conversation with a long-time friend and colleague. We talked about the recently passed Secure Act 2.0 and potential behavioral implications and impacts on the ecosystem and players.

For those unfamiliar with Secure Act 2.0, this legislation covers finance and retirement-related considerations. Just to give some examples without covering the breadth, the Act includes items such as whether employers must provide automatic savings rate escalators in their plans, what escalator caps might be, how student debt might be addressed in the context of savings, and changes in the future age at which retirement savings of an individual must start to be withdrawn.

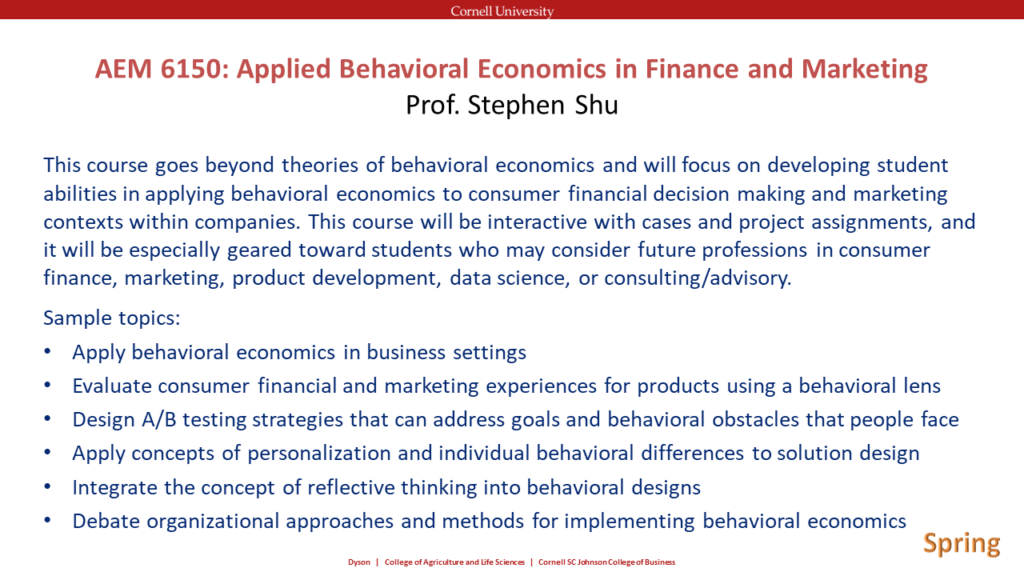

Each of these changes have potential behavioral implications. Let’s take just one of five behavioral angles I cover at Cornell in my applied behavioral economics courses, namely choice architecture. Defaults are an important tool within the realm of choice architecture and have shown to have big impacts on people’s choices (Carroll et al., 2009; Johnson and Goldstein, 2003; Johnson et al., 2012). Has your company done a behavioral audit on the implications to constituents of specific defaults, such as default values, structure, and outcomes? What if people don’t accept defaults? What happens then in the customer experience? Have you thought about implications to your company? Should your company make any changes?

We also have to acknowledge that consumer choices are often not made in isolation. For example, by increasing the age at which people are required to take minimum distributions from retirement, how might this affect other choices? For example, what impact might it have on how people think about claiming Social Security? Thinking architecture, such as how people construct their preferences using a mixture of fast and slow thinking processes (Payne et al., 1999), is another behavioral angle to consider.

Where does this leave us? In the case of Secure Act 2.0, one way to look at this is in terms of an exogeneous event that constituents have to react to (e.g., employers, advisors, platforms, systems providers, investment managers). However, there will also be those that look at this as an opportunity. There will be some players that will be way more agile than others and able to capitalize on both important behavioral implications and operational tactics.

But this discussion isn’t limited to Secure Act 2.0…

Whether facing an exogeneous event or proactively working an important business problem, here are three strategies informed by behavioral economics that companies and individuals can use:

- To avoid blindspots with group decision making, consider setting up a Red Team to approach problem and think way outside of the box (Cass Sunstein discusses Red Teaming in his book, Wiser). My twist would be that you might consider setting up a Behavioral Red Team or a Red Team with behavioral economics advisor embedded within.

- Anchoring is a powerful force that inhibits change. Use a whiteboard exercise to think about ideal approaches to solving a problem. Maybe it can be part of a Spring-cleaning or offsite event for your company.

- Use behavioral lenses to examine the problem. A choice architecture lens, such as the way defaults are used, is one such lens. But there are other lenses out there, such as the way information is framed. (See Shu et al. for an example of reframing savings decision using pennies and potentially heterogenous treatment effects on people with different income levels).

References:

- Carroll, Gabriel D., James J. Choi, David Laibson, Brigitte C. Madrian, and Andrew Metrick. “Optimal defaults and active decisions.” The Quarterly Journal of Economics 124, no. 4 (2009): 1639-1674.

- Johnson, Eric J., and Daniel Goldstein. “Do defaults save lives?.” Science 302, no. 5649 (2003): 1338-1339.

- Johnson, Eric J., Suzanne B. Shu, Benedict GC Dellaert, Craig Fox, Daniel G. Goldstein, Gerald Häubl, Richard P. Larrick et al. “Beyond nudges: Tools of a choice architecture.” Marketing Letters 23, no. 2 (2012): 487-504.

- Payne, John W., James R. Bettman, David A. Schkade, Norbert Schwarz, and Robin Gregory. “Measuring constructed preferences: Towards a building code.” In Elicitation of Preferences, pp. 243-275. Springer, Dordrecht, 1999.

- Shu, Stephen, Hal Hershfield, Richard Mason, and Shlomo Benartzi. “Reducing Savings Gaps Through Pennies Versus Percent Framing.” (Working Paper 2022).

- Sunstein, Cass R., and Reid Hastie. Wiser: Getting beyond groupthink to make groups smarter. Harvard Business Press, 2015.