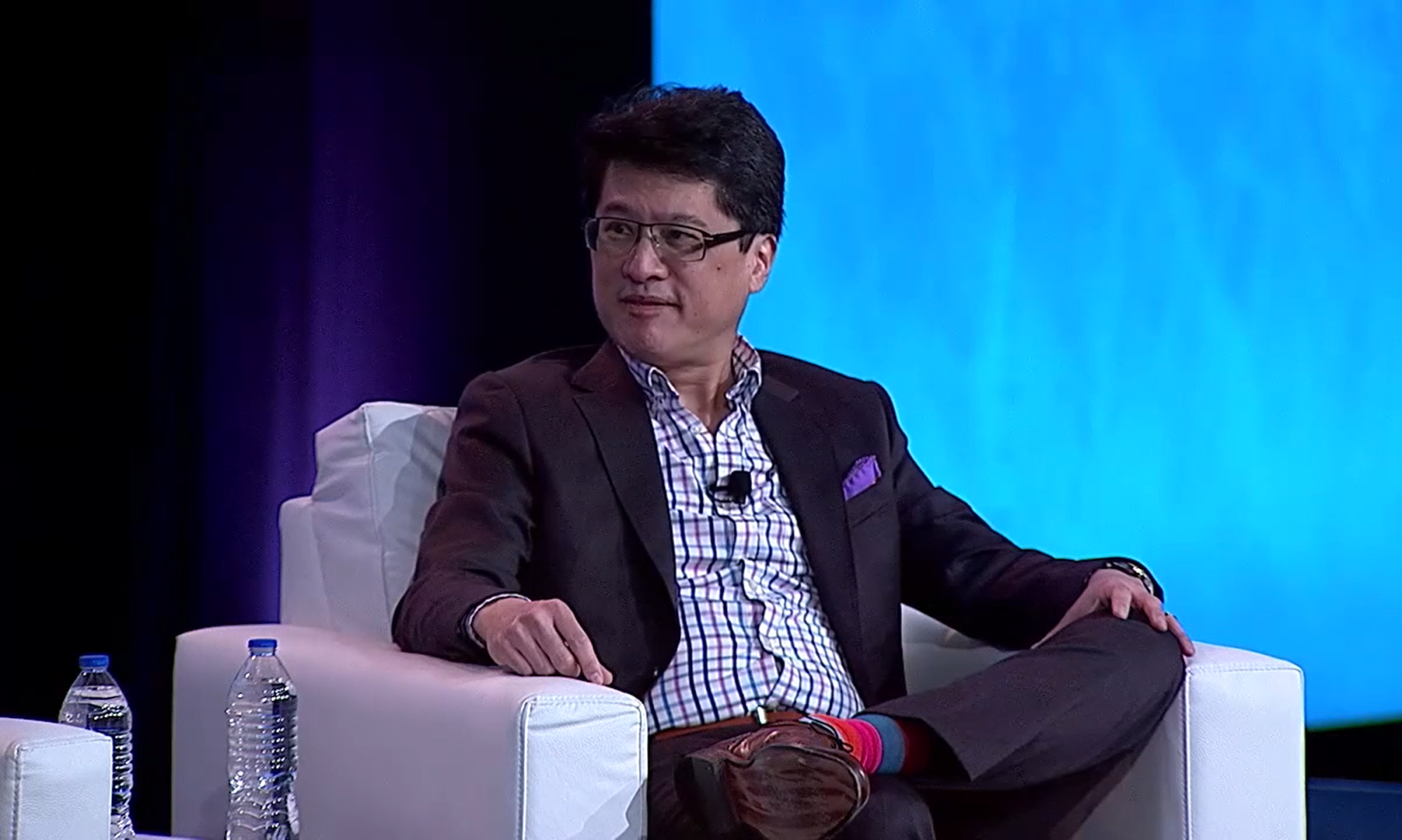

Last month I chatted with Tony Roth, Chief Investment Officer at Wilmington Trust, N.A., a subsidiary of M&T Bank (NYSE: MTB) as part of his podcast series, Capital Conversations. For me, it was an interesting conversation to have had for a number of reasons, and three perspectives really captured the direction of my thinking.

The first perspective was that as a society we have really been under a lot of stress for the past two years, a type of stress that I have not seen in my lifetime. So while investment markets are not currently very volatile, it is a good time for many people to get a fresh start and re-assess their situations.

The third perspective is that people are really different, and sometimes it can matter a lot. We understand some of these differences better than others (such as innumeracy and its impacts). There are other differences (like capability and confidence mismatches relative to new technologies, like cryptocurrency) that are less understood. As another example, the younger generation thinks about finance and life very differently than older generations. How to better address individual behavioral differences and situations will be an ongoing opportunity where people will need help.

The second perspective was that there are so many different behavioral elements at play when we think about different people, the interplay of fast, automatic thinking versus slow, reflective thinking; the digital world, and the numerous challenges of finance. It is unlikely that we can find one silver bullet, behavioral solution to fully address all problems. That said, we can put in place processes to help ensure that we make the best decisions we can for the things that really matter, while also avoiding some of the major obstacles that happen on a regular basis, such as overconfidence, natural biases in forecasting the future, thinking in narrow frames, and others.

Thanks to Tony Roth and the Wilmington Trust team for hosting me for the podcast.